Understanding Monetary Policy Decisions: A Guide to Their Impact on the Economy

Introduction: The Role of Monetary Policy

Monetary policy, implemented by central banks, plays a crucial role in managing the economy. It involves controlling the supply of money and interest rates to influence factors such as inflation, employment, and economic growth.

Key Monetary Policy Tools

1. Open Market Operations

Central banks buy and sell government securities in the open market to regulate the money supply. Purchases increase the money supply and lower interest rates, while sales reduce the money supply and raise interest rates.

2. Discount Rate

This is the interest rate charged to banks for borrowing money from the central bank. Adjusting the discount rate influences lending rates in the economy, impacting investment and consumption.

3. Reserve Requirements

Central banks set the percentage of deposits that banks must hold as reserves. Increasing reserve requirements reduces the money available for lending, while decreasing them increases the money supply.

Monetary Policy Objectives

1. Price Stability

Central banks aim to keep inflation low and stable to maintain the purchasing power of money and foster economic growth.

2. Full Employment

Monetary policy helps achieve maximum employment by fostering economic growth and job creation.

3. Economic Growth

By influencing interest rates and the money supply, central banks can stimulate growth and investment in the economy.

Influence on Inflation and Interest Rates

Inflation, a sustained increase in the general price level, is a key target of monetary policy. Central banks can lower inflation by raising interest rates to curb lending and demand, and vice versa.

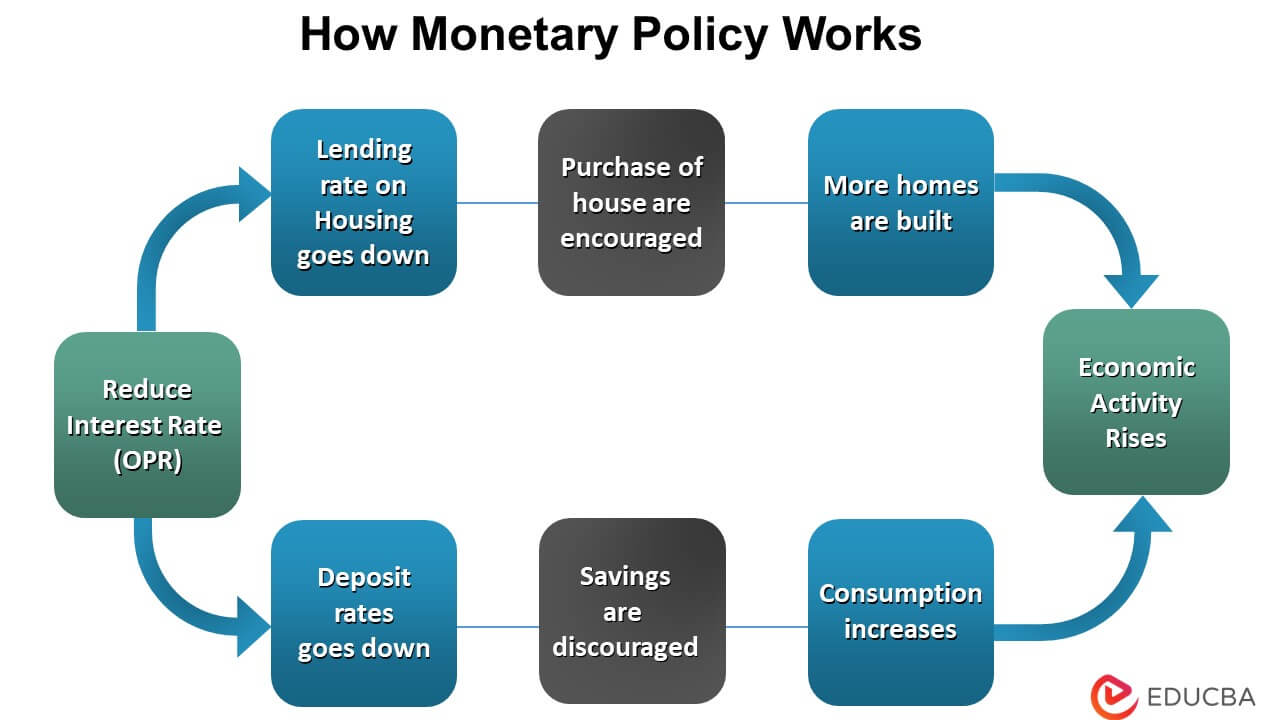

Interest rates also affect borrowing costs for businesses and individuals. Lower interest rates encourage borrowing, investment, and consumption, while higher interest rates have the opposite effect.

Impact on Economic Growth and Unemployment

Monetary policy can influence economic growth by affecting lending rates. Lower interest rates stimulate investment and consumption, leading to job creation and economic expansion. Conversely, higher interest rates can slow down economic activity and increase unemployment.

The Importance of Independence

Central banks should be independent from political influence to make unbiased monetary policy decisions based on economic data and analysis.

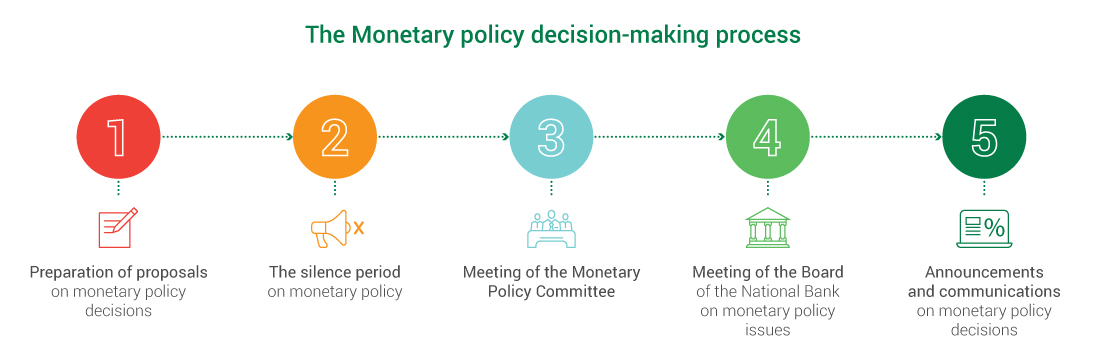

Monetary Policy in Practice

Central banks regularly assess economic data and adjust monetary policy tools to achieve their objectives. They communicate their decisions and rationale through press releases and speeches.

Conclusion: The Significance of Monetary Policy

Monetary policy is a powerful tool that central banks use to manage the economy. By understanding the key tools, objectives, and impact of monetary policy, we can appreciate its influence on inflation, interest rates, economic growth, and unemployment. As we navigate ever-changing economic conditions, the decisions made by central banks play a vital role in shaping our financial and economic landscape.

Komentar